INJECTIVE PROTOCOL BOUNTY PROGRAM

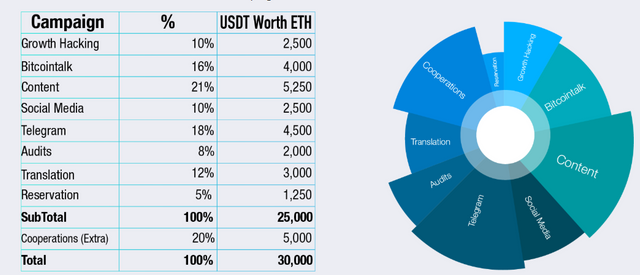

INJECTIVE PROTOCOL team is holding a 6-week Official Bounty Program to reward its supporters with ETH tokens between June 20, 2020 and July 31, 2020(CST). 30,000 USDT worth ETH will be allocated to the bounty program. (We may temporarily halt the bounty program in the event we discover any issues that may comprise member benefits. Such issues include, without limitation, scam or hacked registrations. The restart notice will be announced in the Telegram Group and Review Spreadsheet. Each working phase will remain at two working weeks per phase. Therefore, the entire bounty schedule may be extended accordingly.)

Financial company groups are established with the goal of managing and regulating the supply of currencies available for circulation.With the growing importance of blockchain technology, the power of exchange services is also increasing. Emerging projects are also beginning to develop. At the same time, most developers use different advanced technologies to engage faster. Therefore, to create a turning point for this industry is essential.

Injective protocol is a completely decentralized and modern cryptocurrency trading exchange equipped with a front running resistant layer 2 exchange protocol developed on the etherum network. It has been designed to support futures, margin trading and derivatives as well.

Running Now! Click the Link for more details!

RULES

- BOUNTY PROGRAM TELEGRAM GROUP : https://t.me/KrypitalBounty

- INJECTIVE PROTOCOL OFFICIAL TELEGRAM GROUP: https://t.me/joininjective

*participate in any bounty campaigns you must join the Official Injective Protocol Telegram group: https://t.me/joininjective .

*To join the bounty program, please visit our Krypital Bounty Telegram Group: https://t.me/KrypitalBounty Make sure you register in the google forms before you start to work.

*To participate in the bounty program, you must be at least 18 years old.Rewards for each campaign have a max individual cap, no extra rewards will be processed beyonds the cap.

*We will check, review, and filter all registered information daily before each weekly review. Only one account will be allowed for each social media link, and any duplicates will be removed. For invalid links, we will make daily markups to the public Bounty Release Form.

*Please correct invalid link information and register again. You can request a review to check your weekly stake if you think it is wrong within 7 days after each week release.

*We will not make any adjustments if you pass the deadline.If you are disqualified for any reason, you will NOT receive any bounty rewards.The bounty team reserves the rights to make any changes to the rules or terms of conditions, if deemed necessary. For technical support during the bounty campaign, please contact Krypital Bounty Telegram Group : https://t.me/KrypitalBounty

*The bounty rewards will be basically calculated every 2 weeks. Thus, there will be 3 periods of the bounty program in 6 weeks.

If the total number of stakes earned during campaign exceeds the cap, we will adjust your stakes based on the following formula:

Your final USDT worth of ETH =

(Bounty campaign pool / Total number of stakes everyone earned during the campaign) * Number of stakes you earned

*If not, 1 stake = 1 USDT worth ETH.

Who Is Controls the Injective Protocol Official Bounty Program

Krypital Group for their multi-dimensional support for the development of our project. Krypital Group will deliver a series of tailor-made global marketing campaigns, which aim to solidify the global reputation of Injective Protocol as well as maximizing the impacts of all upcoming operational and marketing strategies.Krypital Group is a leading global blockchain incubator and venture capital. Focused on venture funding, one-stop consulting and brand management services, Krypital Group supports dedicated projects with great potentials.

The Business Model

What is the Business Model? The plan is that in the third quarter of 2020, Injective Protocol will release mainnet. This is a decentralized exchange service with the first end-to-end concept in the world, this service will later handle the global derivatives market which is certainly universal. To make it easier for users to do or enjoy the service, the plan is the Injective Protocol will provide a beta test net that is equipped with a tutorial so that it can be tried directly by the developers.

Injective Protocol is a fully decentralized dex. To maximize its functionality, support effective interaction and trading, the Injective Protocol will launch the INJ. Details about the token are not released yet, the dev team will immediately announce it if all the preparations are complete, please wait for announcements.

The business development associate will introduce Injective Protocol to the broader community. Must be fluent in English and preferably Chinese/Korean. He/she will have a set agenda to grow our community, meet new business contacts, and enhance the reach of Injective Protocol. The associate represents the values of the company and is an integral member of the team.

Injective Protocol is a decentralized layer-2 peer-to-peer protocol that aimsto enable fast and secure perpetual swaps, futures, leverage and spottransactions on Ethereum. The partnership will facilitate the transaction by leveraging WOOTRADE's transaction depth of 100 BTC with a spread of 0.05%. This liquidity stems from the in-depth aggregation of major exchanges, and the support of quantitative investment research institution Kronos Research for market-making strategies. Kronos has a daily transaction volume of $1 billion. In order to provide sufficient liquidity, WOOTRADE will also provide a low rate of 0% for connected exchanges, which saves hedge costs for exchanges. All in all, this collaborative effort will lead to a paradigm shift in the DeFi world.

WOOTRADE was incubated by Kronos Research, a leading quantitative investment research institution, and is funded by distributed capital from DFund, SNZ, Hashkey, as well as vector capital investment. The dark pool has a team that

brings extensive experience in trading crypto assets and secondary assets. The top institutional trader has the technical expertise to manage high-level crypto market derivative products. Injective Protocol's derivatives protocol and technology-driven ecology can provide institutional traders, such as Kronos Research, with the ideal environment and conditions for the fastest, safest and most fair service for its markets and products.

Decentralized Finance and Derivatives

Decentralized Finance (DeFi) has been a hot topic over the past few years and the mixture of DeFi and the booming derivatives market is something that many are keen to take a look at. Over the past 365 days, the market has grown from a trading volume of around 2.5 billion dollars to one that is over 21 billion dollars, and it doesn’t seem to be slowing down.

More recently, according to a report written by Messari on the year-to-date returns of decentralized exchange (DEX) tokens when compared to that of centralized exchange tokens, it was found that DEX tokens outperformed the latter by more than five times. It shows immense growth within the DeFi space and cryptocurrency trading and that now is a prime time to pump out more innovations in the space. In particular, derivatives in crypto have huge, proven potential and market fit evidenced by the meteoric rise of centralized derivatives exchanges this past year.

Despite their popularity and massive worldwide volume, derivatives are highly regulated through financial markets globally. While other derivatives DEXes are currently in operation, either with Ethereum BTC or Ethereum USDC, there is not much creativity yet. This conservative approach could be due to the opinion that as derivatives DEX goes, it is not recommended to try to do mainstream markets from the beginning, such as Ethereum BTC, because users will still use the more liquid CEX, resulting in a lack of users and liquidity. On the flip side, DEXes open the door to trading decentralized derivatives on the blockchain; the room for imagination is infinite.

With diversified products and diversified trading markets, the potential for the future in terms of trading capacity is massive. DeFi can boost the market value of the entire crypto assets space exponentially, yet there is much work to be done for proper execution.

What can Injective Protocol do?

During our Korean Launch AMA on Kakaotalk, we received a number of questions in regards to derivatives markets and the vision of Injective in regards to these markets (Read about our Korean Launch here). Derivatives in the crypto space have enormous potential and market fit, as centralized derivatives exchanges like Bybit, Deribit, and FTX have proven this past year.

Injective Protocol is fully decentralized in nature, which allows for the permissionless creation of derivative products and these derivatives markets will run on our decentralized peer-to-peer futures protocol.

Injective Protocol supports perpetual swaps, contracts for difference (CFD), and will continue to prepare and provide for other derivatives products. Furthermore, Injective Protocol allows individuals to create and trade on arbitrary derivative markets with just a price feed. We believe that this is a huge, untapped market with much demand and opportunity to serve unmet needs that even current centralized exchanges do not (or rather cannot) meet.

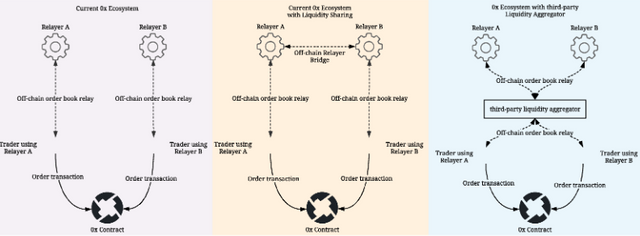

The team resolved the issue head-on regarding user experience by using a Layer 2 protocol. Ethereum’s 15+ second average block time along with its probabilistic finality greatly throttle trade throughput and turnover. This means that market makers cannot react quickly to market changes and thus incur additional risk by making markets on DEXes. The result is that DEXes act as a secondary market where users face more inefficient prices/higher spreads which ultimately results in less liquidity. By implementing our own decentralized trade execution coordinator which allows for free and near-instant order cancellations and greatly increasing trading speed by scaling our exchange execution and settlement on our own Layer-2 chain, these limitations are effectively broken.

This is all powered by the Injective Chain which operates our Layer-2 derivatives platform, serves as a decentralized Trade Execution Coordinator (TEC), with a decentralized orderbook. (Head on over here to read more about our ecosystem)

The Future

DeFi is still very young but is growing extremely quickly. It is fundamentally a freedom enabling technology that will truly change the world and disrupt the existing financial system as we know it. This will of course take time, but believers are working tirelessly to make this a new beautiful reality. Follow us on our journey to transforming these dreams into reality.

Want to get the latest updates and news from the Injective team? Make sure to follow us on our official social media handles:

Website: https://injectiveprotocol.com/

Whitepaper: https://docsend.com/view/zdj4n2d

Telegram: https://t.me/joininjective

Tap into the world of margin trading on derivatives and tokens via our basic interface. Leverage the full potential of our protocol on our pro interface. Stay tuned to our upcoming market listings!

My Details:

Bitciontalk Usename: habibsir

ETH Wallet : 0x90633764b12468790841C157815e46bF7dA7d915

Nhận xét

Đăng nhận xét